Cloud infrastructure revenue surges as AI expansion rolls on

It was a very good year for the big three cloud infrastructure vendors in 2025, and for anyone with even a sliver of market share for that matter. As AI expansion continued unabated, the cloud infrastructure sector pulled in a staggering $419 billion for the year, per Synergy Research.

"GenAI has simply put the cloud market into overdrive. AI-specific services account for much of the growth since 2022, but AI technology has also enhanced the broader portfolio of cloud services, driving revenue growth across the board," Synergy's chief analyst John Dinsdale wrote in the company's quarterly report.

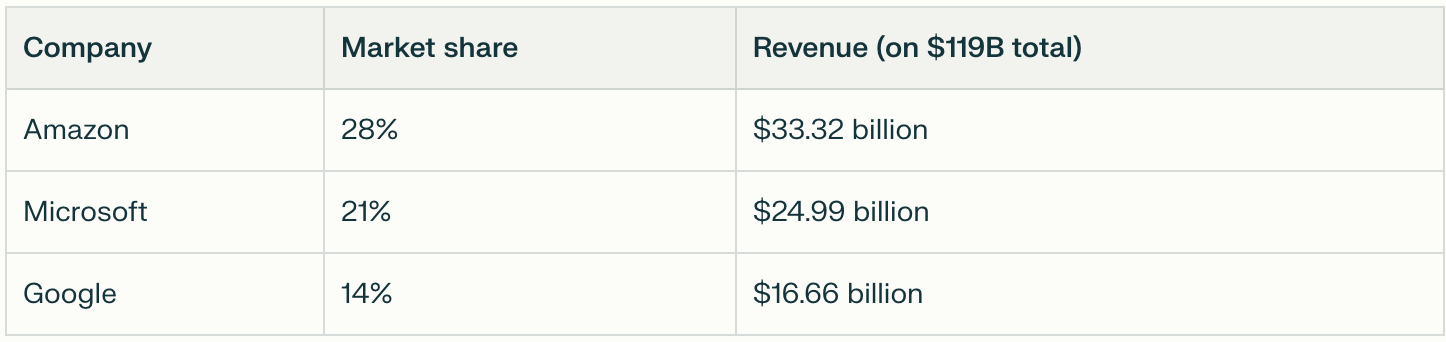

Synergy defines the market as infrastructure, platform and hosted private cloud services. So it doesn't include software services like Google Workspace or Microsoft 365. For the most recent quarter, the sector totaled $119 billion with the big three's share of that haul as follows:

Even much smaller companies benefited: look at neocloud CoreWeave, which catapulted into the top 10 vendors, generating $1.5 billion in quarterly revenue, driven for the most part by AI and GPU services. While this is a fraction of the money that the big three pulled in, a $6 billion run rate is nothing to sneeze at.

The great data center shortage

What's even more remarkable is that the big three likely could have made more if they only had the capacity to meet the demand, a reminder that data center construction could be holding back this sector from reaching even greater heights.

To meet that demand, Amazon, Google and Microsoft have announced enormous CapEx projections, betting that AI-driven cloud demand will remain strong enough in the coming years to justify hundreds of billions of dollars in data center investments.

Even so, it’s worth recalling the post-pandemic labor market, when these same companies hired tens of thousands of workers to meet what they believed would be sustained demand — only to reverse course with mass layoffs once growth slowed faster than expected.

The difference this time is that excess capacity can’t be let go with a severance package. If demand projections prove overly optimistic, hyperscalers could find themselves carrying years’ worth of underutilized infrastructure — a far more rigid and expensive mistake than overhiring.

But the hyperscalers are betting that won't happen again, and the capacity crunch will lead to ever more business. Even though we know that markets rarely move in straight lines, for now these vendors believe the road goes on forever and the party will never end.